The Facts About Personal Loans copyright Uncovered

The Facts About Personal Loans copyright Uncovered

Blog Article

Some Known Facts About Personal Loans copyright.

Table of ContentsNot known Details About Personal Loans copyright About Personal Loans copyrightRumored Buzz on Personal Loans copyrightPersonal Loans copyright Things To Know Before You BuyPersonal Loans copyright for DummiesPersonal Loans copyright for DummiesGet This Report on Personal Loans copyright

There could be restrictions based upon your credit history or history. Make sure the lender provides car loans for a minimum of as much money as you need, and aim to see if there's a minimal loan amount too. Know that you could not get approved for as big of a funding as you want.Variable-rate financings often tend to start with a reduced rate of interest price, yet the price (and your payments) can climb in the future. If you want assurance, a fixed-rate lending might be best. Look for online reviews and contrasts of lenders to discover other consumers' experiences and see which lenders can be a good fit based upon your creditworthiness.

This can normally be corrected the phone, or in-person, or online. Depending upon the credit report version the lender utilizes, several hard inquiries that take place within a 14-day (often as much as a 45-day) home window might just count as one difficult inquiry for credit history objectives. Additionally, the racking up design might neglect questions from the previous one month.

Rumored Buzz on Personal Loans copyright

If you obtain accepted for a funding, read the great print. Once you approve a funding offer, many lenders can move the money directly to your checking account.

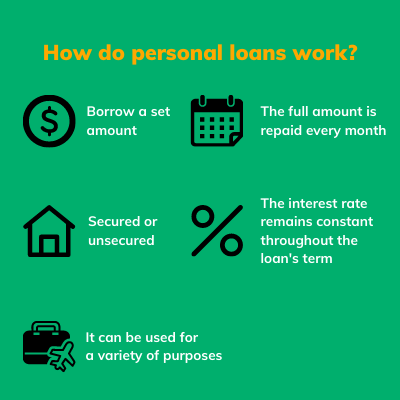

Personal financings can be made complex, and discovering one with a great APR that matches you and your spending plan takes time. Before taking out a personal funding, make certain that you will have the capability to make the regular monthly repayments on time. Personal finances are a quick means to obtain cash from a financial institution and other economic institutionsbut you have to pay the money back (plus passion) over time.

Some Known Incorrect Statements About Personal Loans copyright

Let's dive into what a personal finance in fact is (and what it's not), the factors individuals use them, and how you can cover those insane emergency expenditures without handling the worry of financial debt. An individual finance is a swelling sum of cash you can obtain for. well, nearly anything.

That does not consist of borrowing $1,000 from your Uncle John to assist you spend for Xmas offers or letting your flatmate area you for a pair months' lease. You shouldn't do either of those points (for a number of factors), but that's technically not a personal funding. Personal loans are made with an actual monetary institutionlike a bank, cooperative credit union or on the internet lending institution.

Let's take an appearance at each so you can recognize precisely how they workand why you don't need one. Ever before. Most individual fundings are unprotected, which suggests there's no collateral (something to back the car loan, like a cars and truck or house). Unsafe car loans usually have greater rate of interest and call for a better credit rating due to the fact that there's no physical product the loan provider can remove if you don't pay up.

Things about Personal Loans copyright

Shocked? That's all right. Despite exactly how excellent your credit score is, you'll still need to pay passion on most individual car loans. There's constantly a rate to spend for obtaining money. Safe individual finances, on the various other hand, have some type of security to "safeguard" the finance, like a watercraft, jewelry or RVjust to name a couple of.

You might likewise take out a protected personal loan using your vehicle as collateral. Trust us, there's absolutely nothing safe and secure concerning secured financings.

:max_bytes(150000):strip_icc()/Term-Definitions_loan.asp-b51fa1e26728403dbe6bddb3ff14ea71.jpg)

Personal Loans copyright for Beginners

Called adjustable-rate, variable-rate finances have interest prices that can transform. You could be attracted in by the deceptively low rate and tell on your own you'll repay the lending swiftly, yet that number can balloonand quick. It's simpler than you believe to obtain stuck with a higher rates of interest and regular monthly repayments you can not pay for.

And you're the fish hanging on a line. An installation lending is an individual financing you pay back in fixed installations in time (generally when a month) until it's paid completely. And do not miss this: You need to repay the initial finance amount before you can borrow anything else.

Do not be misinterpreted: This isn't the exact same as a credit scores card. With credit lines, you're paying passion on the loaneven if you pay on schedule. This kind of finance is incredibly tricky due to the fact that it makes you assume why not try these out you're managing your financial debt, when really, it's handling you. Payday advance loan.

This gets us irritated up. Why? Due to the fact that these companies victimize people who can not pay their bills. Which's simply incorrect. Technically, these are short-term lendings that give you your income ahead of time. That may appear confident when you remain in a monetary wreck and need some cash to cover your expenses.

The Definitive Guide for Personal Loans copyright

Since points get real messy actual quick when you miss a settlement. Those financial institutions will come after your pleasant grandmother that guaranteed the finance for you. Oh, and you should never guarantee a car loan for anybody else either!

All you're actually doing is using new financial debt to pay off old financial debt (and expanding your lending term). Companies visit homepage know that toowhich is specifically why so several of them use you combination finances.

You just get an excellent credit history by borrowing moneya great deal of money. Around right here, we call it the "I love debt rating." Why? Since you take on a ton of debt and risk, just for the "privilege" of going into much more debt. The system is rigged! Do not stress, there's great news: You don't need to play.

Personal Loans copyright - An Overview

And it starts with not obtaining any even more cash. ever. This is an excellent guideline for any type of economic acquisition. Whether you're considering obtaining a personal lending to cover that kitchen remodel or your overwhelming bank card expenses. don't. Getting debt to pay for things isn't the way to go.

And if you're thinking about a personal loan to cover an emergency, we obtain it. Borrowing money to pay for an emergency situation only rises the tension and difficulty of the circumstance.

Report this page